If neither you nor your spouse (if any) is often a participant in a office strategy, then your standard IRA contribution is often tax deductible, irrespective of your money.

Like commodities, real-estate is an additional alternate investment which is well-liked for its inflation-evidence Houses and constructive reputation all through times of soaring prices.

Not each sector of the economy is afflicted by inflation equally. To safeguard your investments, allocate money to resilient sectors that can sustain stable desire and pricing ability:

Though Suggestions may perhaps appear like a pretty investment, Here are a few hazards that are crucial for traders to remember. If there is deflation or The customer Value Index (CPI) is slipping, the principal amount of money may perhaps fall.

Build up your savings is like getting a safety net to capture you if there’s an unanticipated price that triggers a monetary hardship.

What’s your following go? Get started preparing now and be certain your wealth keeps escalating—Irrespective of how high inflation rises.

Power and Agricultural Commodities: Crude oil, wheat, and soybeans tend to increase in value alongside inflation. Bigger manufacturing and transportation fees push commodity selling prices upward, creating them useful hedging instruments.

Roth accounts, on the other hand, supply a definite advantage. Certified withdrawals are tax-free of charge When the account is held for at least five years and the person is fifty nine½ or more mature. This structure allows retirees to handle taxable cash flow more efficiently, potentially keeping away from higher tax brackets.

Managing early withdrawal penalties is an important Portion of retirement setting up. Both equally common and Roth accounts impose a ten% penalty on early withdrawals, usually before age fifty nine½, Along with common revenue taxes. This could certainly noticeably reduce the price of early distributions.

With mounting inflation, bonds with set curiosity charges get rid of their attractiveness considering the fact that your purchasing ability decreases with better inflation.

These stocks and ETFs are several of the most effective inflation-evidence investments and will go on to glow as price development cools.

Property crowdfunding platforms can be a way to take a position in property although finding the good thing about Experienced property management.

That’s why it’s crucial to be diversified, and Meaning investing further than shares by yourself. Regardless of whether the stock market continues to rise rapidly in the approaching months, retain ample positions in the two set-income investments and funds.

You have got some ways to guard your wealth to ensure that Your important source loved ones may be extra more likely to continue to be fiscally stable regardless of whether the unpredicted occurs. Underneath are 6 well-liked wealth protection strategies that will assist you to greater guard your assets.

Scott Baio Then & Now!

Scott Baio Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Kane Then & Now!

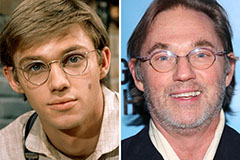

Kane Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!